SMEs in Vietnam: How to Manage Revenue Transparently Under the New Tax Policy

Vietnam’s newly announced tax policy has raised concerns among many shop owners and small businesses. Will their revenue be scrutinized? Will they need to purchase accounting software or completely overhaul their bookkeeping processes? These concerns are valid — but the root of the issue often lies not in the policy itself, but in how businesses manage their operational data.

This article will help small and medium-sized enterprises (SMEs) understand the latest transparency requirements under Vietnam’s new tax rules. It will also outline practical ways to manage order processing and cash flow effectively, with solutions that fit businesses of all sizes.

1. New Tax Regulations: What They Mean for SMEs

Key Changes in the New Tax Policy

The new tax regulations place strong emphasis on transparency, especially for small businesses and SMEs. One major shift is the wider application of digital tax reporting and enhanced monitoring of transactions on digital platforms. Specifically:

-

Tax reporting will no longer rely on paper-based records. Instead, tax authorities will access digital data from banks, e-commerce platforms (Shopee, Lazada, Tiki, Facebook, Zalo), and third-party payment providers.

-

From June 1, 2025, businesses with annual revenue above VND 1 billion in sectors such as retail, F&B, transportation, and hospitality will be required to issue e-invoices through POS systems connected to the tax authority. SMEs without proper sales systems should start preparing now.

-

Additionally, tax authorities will step up monitoring of cash flow through stronger integration with banking and e-commerce data. It will become increasingly difficult to conceal off-the-books revenue or expenses.

- Starting from April 1, 2025, e-commerce platforms will also be required to withhold and pay taxes on behalf of individual sellers. SMEs must therefore closely monitor revenue from each sales channel to avoid errors or underreporting.

With these changes, manual bookkeeping is no longer sufficient. Any gaps or inconsistencies in revenue reporting can be easily detected. SMEs must adopt systematic processes and tools to manage their financial data accurately.

Which SMEs Will Be Most Affected?

-

Small online businesses without proper accounting practices are most at risk. Many shops operate informally across multiple sales channels without clear records of revenue and expenses.

-

SMEs selling across multiple platforms without a centralized order management system are also vulnerable. Discrepancies between channels can lead to reporting errors and tax penalties.

-

Businesses using multiple payment methods — including e-wallets, COD, and bank transfers — must ensure that all revenue is properly recorded. These transactions will now be subject to greater scrutiny by tax authorities.

3 Common Challenges for Unprepared SMEs

First, fragmented revenue data. Many shop owners don’t know their true monthly revenue, making accurate tax reporting difficult.

Second, lack of inventory reconciliation. Inconsistencies between reported revenue and stock levels are a major red flag for tax inspectors.

Third, missing documentation for discounts, returns, and refunds. Without proper records, these legitimate expenses may not be accepted for tax deductions — resulting in higher tax liability.

⚠️ Reminder: Transparency doesn’t have to be complicated. With the right tools, SMEs can manage clean financial data without needing advanced accounting software.

2. Why Transparent Revenue Management Helps SMEs Manage Taxes More Effectively

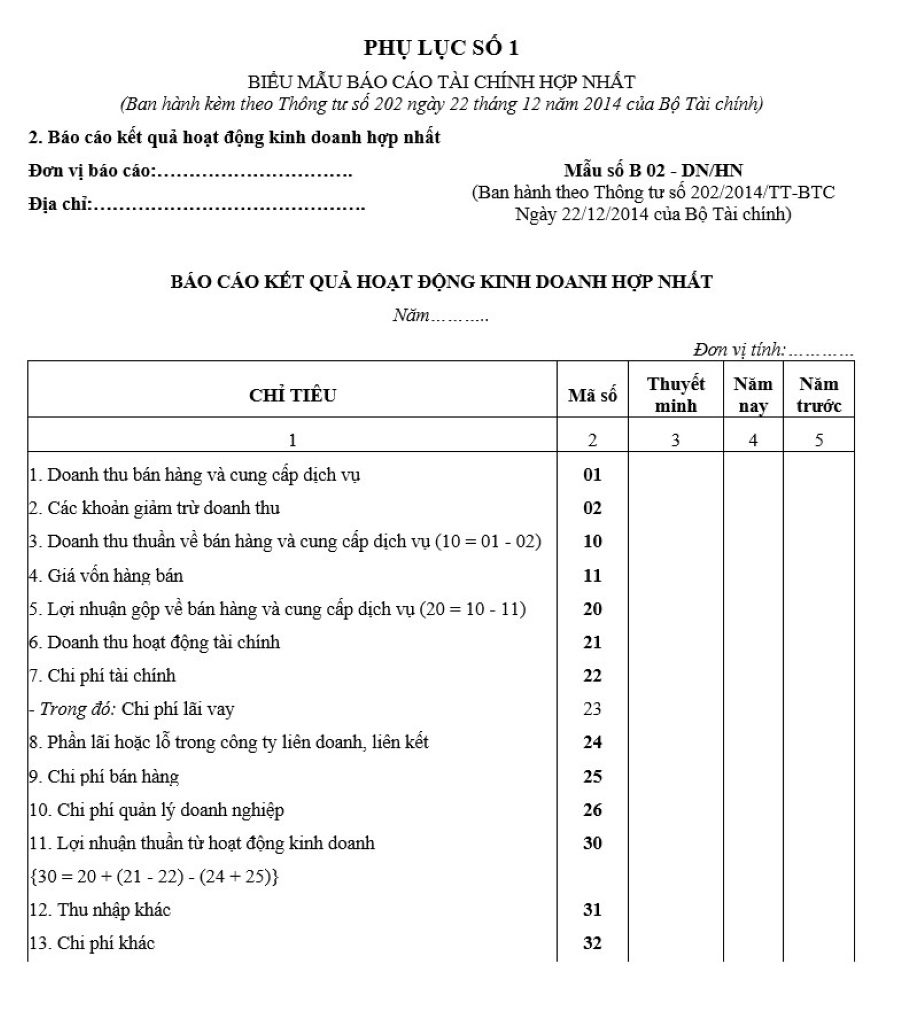

A sample financial report

Fear of Tax Audits Often Stems from Poor Data Control

Many SMEs are not afraid to pay taxes — but they fear working with tax authorities due to concerns about data accuracy. Without a clear picture of revenue and expenses, reconciling data from e-commerce platforms and bank records becomes stressful.

The lack of cash flow reports and proper inventory management leaves businesses exposed. Even unintentional reporting errors can result in penalties, fueling a cycle of fear and tax avoidance.

In reality, with proper preparation, SMEs can confidently manage their data and engage with tax authorities transparently — avoiding unnecessary risks.

Centralized Order Management Ensures Accurate Tax Reporting

One of the keys to effective tax management is centralized order management. Having a clear, unified view of revenue by day, week, and month ensures accurate tax declarations.

As multi-channel selling becomes more common (Shopee, TikTok, website, Facebook, offline), consolidating orders across platforms is essential. Without this, shop owners may struggle to calculate total revenue accurately.

Simple order management systems (OMS) can automate this process. By bringing all orders into one view, businesses can confidently reconcile revenue when dealing with tax authorities.

Reducing the Risk of Errors with Synchronized Data

Many SMEs incur penalties not because of tax evasion but due to data inconsistencies — such as revenue on Shopee not matching POS system data, or unrecorded Facebook orders.

Synchronizing order and revenue data allows businesses to identify and correct discrepancies before filing tax returns — minimizing the risk of penalties.

Additionally, transparency builds trust with banks and business partners, helping SMEs access funding and scale more effectively.

📊 Tips: Businesses should centralize all sales data in one system. This not only simplifies tax reporting but also enhances operational control and decision-making.

3. Practical Tools and Strategies to Help SMEs Manage Orders and Revenue Effectively

Tax officers of the Tax Department guide business households to deploy electronic invoices from POS

(Image: Quân đội nhân dân 2025)

From Simple to Advanced Solutions

Not every SME needs to invest in complex software from the start. The key is to adopt tools that match current needs and expand gradually as the business grows.

- For new SMEs, an Excel file can be sufficient — as long as it is regularly updated and maintained. This ensures visibility over revenue and expenses.

- As businesses expand to multiple channels (Shopee, Lazada, TikTok Shop, Facebook), automated order consolidation tools become essential to prevent errors when aggregating revenue data.

Building an Effective Operational Process

Regardless of the tools used, SMEs should establish clear processes to make tax reporting easier. A basic workflow includes:

- Consolidating orders from all sales channels into a centralized system

- Tracking revenue daily to monitor actual cash flow

- Performing regular inventory checks to ensure consistency between stock and revenue

- Reconciling cash flow weekly to identify and resolve discrepancies early

- Preparing tax reports from validated data — not rushing at the last minute

With a well-structured process, tax reporting becomes less stressful and more accurate.

Choosing the Right Tools Based on Business Size and Capability

It’s not necessary to invest in expensive accounting software from the beginning. SMEs should choose tools that align with their size, budget, and internal capabilities.

- For small shops, a free or basic OMS combined with simple cash flow tracking is often sufficient.

- For mid-sized businesses, adding inventory management software provides better control over stock, cost of goods sold, and simplified financial reporting.

- The most important step is to establish transparency from day one. Once SMEs have a solid foundation of clean data, working with tax authorities becomes much easier.

✅ Advice: You don’t need complicated systems. A clear, easy-to-use order and cash flow management solution is the key to helping SMEs manage taxes effectively.